Complete Guide to Cash Flow Management

Effective cash flow management is the backbone of any successful business.

According to a report by U.S. Bank, 82% of small businesses that fail cite cash flow problems as the main factor. This highlights the critical importance of effectively managing your cash flow to ensure the success of your business.

Cash flow is much more than just covering immediate expenses; it is crucial for ensuring the financial health and stability required for your business’s long-term success.

Effective cash flow management involves monitoring the movement of money in and out of your business, ensuring you have the necessary funds to meet expenses, invest in growth, and navigate financial challenges.

This is why proactive cash flow management is vital. It enables sustainable growth, enhances financial stability, and offers greater flexibility to seize new opportunities. By understanding and managing your cash flow before issues arise, your finance team can make informed decisions regarding broader strategic objectives and avoid the pitfalls that 82% of businesses face.

So, how do you begin managing cash flow effectively? This guide serves as an excellent starting point.

Here, you’ll find valuable insights, practical tips, and step-by-step instructions to effectively manage your cash flow and ensure your business remains financially secure.

What is Cash Flow Management?

Cash flow management is the process of tracking, analyzing, and optimizing the flow of cash in and out of a business. It involves managing the timing and amount of cash inflows and outflows to maintain a healthy financial position and meet financial obligations.

Simply put, it ensures that your enterprise has the necessary funds to meet its obligations while also positioning itself for growth and expansion.

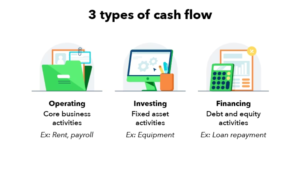

Cash flow can be categorized into three main types:

- Operating Cash Flow: This refers to the money generated from your business’s primary activities, such as sales of goods and services. It is a crucial indicator of your business’s ability to generate sufficient revenue to sustain daily operations.

- Investing Cash Flow: This includes cash spent on or gained from investment activities, such as purchasing or selling assets, property, or equipment. This type of cash flow reflects your business’s long-term investment strategy and its impact on financial health.

- Financing Cash Flow: This represents the cash exchanged between your business and its investors or creditors. It encompasses activities like issuing shares, repaying loans, or paying dividends. Positive financing cash flow indicates capital inflows, while negative financing cash flow may signal debt repayments or dividend distributions.

Importance of Cash Flow Management

Cash flow management is not just a fancy financial term; it’s the lifeblood of your business. Think of it like the oil in an engine.

Without it, your business might grind to a catastrophic halt.

In fact, More than 40% of businesses have added cash management tools to optimize cash flow and working capital during the COVID-19 pandemic.

Financial Stability

The primary reason why cash flow management holds such importance is the stability it affords your business.

By monitoring cash inflows and outflows closely, you can ensure that you always have enough to cover your operating expenses. This means paying your employees, suppliers, and other creditors on time, avoiding late fees or the risk of insolvency.

In short, effective cash flow management keeps your business running smoothly day-to-day.

Seizing Growth Opportunities

A healthy cash flow isn’t just about survival; it’s about positioning your business for growth.

Positive cash flow provides the capital necessary for reinvestments, such as marketing campaigns, product development, or expansions into new markets.

With a good handle on your cash flow, you’re better equipped to seize opportunities as they arise, rather than hesitating because of financial uncertainty.

Building Creditworthiness

Your cash flow management practices significantly influence how lenders and investors view your business.

Demonstrating consistent, healthy cash flow can make your business more attractive to potential investors and increase your chances of getting loans at favorable rates.

Efficient Crisis Management

Every business faces rough patches due to market fluctuations, unexpected expenses, or other unforeseen challenges.

Effective cash flow management equips you to weather these storms.

With a robust cash flow strategy, you can navigate economic downturns without drastically reducing essential operations or, worse, shutting down entirely.

Improved Decision Making

You can make more informed decisions when you have a clear picture of your cash flow.

With accurate cash flow projections and real-time monitoring, you can determine the best times to make significant expenditures and when to conserve cash. This foresight helps you execute strategic initiatives with confidence and efficacy.

Relationships with Suppliers and Creditors

Maintaining healthy cash flow improves your relationships with suppliers and creditors.

Timely payments foster trust and may even put you in a position to negotiate better terms, like discounts or extended credit periods. It ensures that your business is seen as a reliable partner, which can be advantageous in many ways, from securing better deals to gaining priority during inventory shortages.

Cost Management

Effective cash flow management also involves monitoring expenses and ensuring that they align with revenue streams.

This helps prevent the wasteful expenditure of resources and promotes a more prudent allocation of funds. It forces you to critically assess spending habits and encourages cost-saving measures contributing to your financial health.

Competitive Advantage

Finally, well-managed cash flow can give you a competitive edge. You can stay ahead in your industry by having the resources to invest in new technology, expand your team, or enter new markets before your competitors do.

Financial agility allows you to adapt swiftly to market changes, making your business more resilient and competitive in the long run.

What are the Key Components of Cash Flow Management?

To manage cash flow effectively, it’s essential to focus on several key components:

- Cash Flow Projections: Forecasting future cash flows helps you anticipate periods of surplus or shortage, enabling informed decision-making and strategic planning. Utilize tools and software for accurate cash flow forecasting based on historical data and market trends.

- Budgeting: Develop a comprehensive budget that outlines expected revenue and expenditures. Regularly compare actual performance against your budget to identify variances and make necessary adjustments.

- Receivables and Payables Management: Implement efficient policies for invoicing and collections to ensure timely receipt of customer payments. Likewise, manage payables to optimize cash outflows, taking advantage of favorable credit terms suppliers offer when possible.

- Expense Control: Review your business expenses regularly to identify areas for cost reduction without compromising quality or efficiency. Implement cost-saving measures and eliminate unnecessary expenditures.

- Cash Reserves: Maintain an adequate cash reserve to cushion your business against unexpected expenses or economic fluctuations. This safety net ensures you can continue operations even during financial turbulence.

- Short-term Financing Options: Familiarize yourself with short-term financing options, such as lines of credit or short-term loans. These options can provide temporary relief during cash shortages without long-term financial commitments.

Cash Flow Management Process

Cash flow management involves three key components: cash flow analysis, cash flow forecasting, and cash flow optimization.

One of the most straightforward ways businesses can oversee their cash flows is by preparing a cash flow statement (CFS). This statement can be created using cash flow management software or a simple Excel spreadsheet.

A CFS simplifies the process of monitoring all cash inflows and outflows, allowing businesses to proactively identify potential risks of cash shortages.

Cash Flow Analysis

Effectively managing a business’s finances isn’t just about tracking numbers—it’s about understanding them. Cash flow analysis is pivotal in the overall cash flow management process.

It involves a systematic approach to reviewing and understanding your cash flow statements, identifying patterns and trends, and conducting scenario analyses.

To conduct a cash flow analysis, you’ll need to have your cash flow statement at hand. This document should detail your business’s income and expenses, either on a monthly or annual basis.

Let’s break down these critical components to provide a clear roadmap for mastering cash flow analysis.

Regular Review of Cash Flow Statements

The foundation of any robust cash flow management process is the regular review of cash flow statements.

Your cash flow statement offers a snapshot of the actual cash movements in and out of your business over a specific period. This isn’t just a formality; it’s an insightful practice that uncovers the everyday realities of your business’s financial health.

Conduct these reviews monthly—or even weekly—depending on your business size and complexity. Regular scrutiny helps you keep a pulse on your liquidity, spot discrepancies early, and make informed decisions.

By routinely analyzing these statements, you ensure your finances remain transparent and understandable.

Identifying Patterns and Trends

Once you’ve established a habit of regular review, the next step is to dig deeper and identify patterns and trends.

This is where your analytical prowess comes into play. Look beyond the raw numbers to discern recurring patterns in your cash inflows and outflows.

Are there seasonal peaks and troughs in your cash flow? Do certain clients consistently delay payments? Are there months when your expenses spike?

Understanding these patterns equips you with the knowledge to forecast future cash flows more accurately, align your budgeting with these trends, and develop strategies to mitigate potential cash flow issues before they become critical.

For instance, identifying a seasonal dip in cash flow can prompt you to secure short-term financing or adjust your inventory purchases ahead of time.

Scenario Analysis: Preparing for the Unexpected

Even with the best forecasting and trend analysis, unexpected expenses can wrench your financial plans.

This is where scenario analysis becomes invaluable. Scenario analysis involves simulating various positive and negative financial situations to understand their impact on your cash flow.

Draft scenarios that include unexpected expenses, sudden drops in revenue, or late customer payments.

How would these scenarios affect your business’s liquidity? What contingency plans can you adopt to cushion the blow?

Identifying worst-case scenarios and developing response strategies can significantly enhance your business’s resilience.

For example, suppose you simulate a sudden 20% drop in revenue due to market disruptions. In that case, you might discover you need to cut non-essential expenses, tap into cash reserves, or negotiate deferred payments with suppliers.

Scenario analysis ensures you’re not caught off guard by financial surprises and enables you to act swiftly and decisively.

Cash Flow Forecasting

Cash flow forecasting, often called cash forecasting, involves estimating the anticipated inflow and outflow of cash within your business across all sectors over a specified timeframe.

A short-term cash forecast typically spans the next 30 days and helps identify immediate funding needs or surplus cash.

A medium-term cash flow forecast generally covers a period from one month to one year. In contrast, a long-term forecast looks at sales and purchases further into the future—ranging from one to five years or even longer, depending on the business type.

It’s important to note that as a cash flow forecast’s time horizon extends, its accuracy tends to decrease.

Steps for Effective Forecasting

Achieving precise cash flow forecasting requires a systematic approach.

Here’s a step-by-step guide to ensure your forecasts are as accurate and useful as possible:

1. Analyze Historical Data

Start by diving into your historical financial data. Look at your past cash flow statements to identify patterns in your cash inflows and outflows.

Historical data serves as the bedrock of your forecasting efforts since it reflects your business’s actual financial performance over time.

Key aspects to analyze include:

- Seasonal trends: Do certain months or quarters have higher sales or expenses?

- Recurring transactions: What are the regular and predictable cash movements?

- Customer payment histories: Which clients consistently pay on time, and which ones are prone to delays?

A thorough analysis of historical data helps establish a reliable foundation for your forecasts.

2. Project Future Inflows and Outflows

With a clear understanding of your past cash flows, you can now project future inflows and outflows. This projection isn’t just a guesswork exercise; it’s a calculated estimation based on historical trends, current market conditions, and anticipated business activities.

When projecting inflows, consider:

- Expected sales volumes based on market trends and historical data

- Scheduled payments from clients

- Any potential new revenue streams

For outflows, include:

- Regular operational expenses such as salaries, rent, utilities, and supplies

- Planned investments or capital expenditures

- Loan repayments and interest payments

Creating a detailed projection allows you to visualize your cash position in the upcoming months and make necessary adjustments proactively.

3. Consider Cash Flow Timing

Understanding the timing of your cash inflows and outflows is crucial. Even if your business is profitable on paper, timing mismatches between incoming and outgoing cash can lead to liquidity problems.

Ensure your forecast accounts for these timing differences to maintain a realistic picture of your cash flow situation.

For example, if sales typically surge at the end of each quarter, but supplier payments are due at the beginning, you may need to arrange short-term financing to bridge the gap.

Similarly, knowing when major expenses will hit helps you schedule other financial obligations around them to avoid cash crunches.

Cash Flow Optimization

Cash flow optimization refers to the process of enhancing a business’s cash flow by increasing cash inflows, decreasing cash outflows, and improving the timing of cash movements.

This crucial element of financial management enables businesses to maintain a healthy cash balance and ensure they have adequate reserves to meet their financial commitments and achieve their objectives.

The goal of cash flow optimization is to guarantee that a business has the necessary cash to operate effectively and expand.

This involves analyzing the cash inflows and outflows from operating, investing, and financing activities to pinpoint areas where cash flow can be enhanced.

1. Accelerate Cash Collections

Efficient cash collection is your business’s lifeline. The faster you convert sales into cash, the stronger your cash flow.

Here are some practical steps:

- Implement Clear Payment Terms: Clearly outline payment terms in your contracts and invoices. Shorten payment periods if possible, and offer incentives, such as discounts, for early payments.

- Use Invoicing Software: Adopt automated invoicing software to streamline the billing process and reduce delays. These tools can send out invoices promptly, track due dates, and even issue reminders for overdue accounts.

- Offer Multiple Payment Options: Provide your customers with various payment methods such as credit cards, bank transfers, and online payment systems. The easier you make it for them to pay, the quicker you receive payments.

- Monitor Accounts Receivable: Regularly review your accounts receivable aging report to identify and follow up on overdue accounts. Establish a consistent follow-up process to ensure timely collections.

2. Delay Cash Outflows

Just as inflow acceleration bolsters your cash position, strategically delaying cash outflows can further optimize your cash flow.

Here’s how to do it effectively:

- Negotiate Payment Terms with Suppliers: Engage in negotiations to extend payment terms with your vendors. Lengthening these terms from, say, 30 to 60 days can significantly improve your cash flow timing.

- Optimize Inventory Levels: Maintain optimal inventory levels to avoid tying up cash in excess stock. Use just-in-time (JIT) inventory management practices to align inventory purchases with production schedules and sales.

- Schedule Payments Strategically: Time your payments to coincide with your cash inflows. For instance, if you expect a bulk customer payment at the end of the month, schedule larger outflows accordingly.

3. Cut Unnecessary Expenses

Minimizing unnecessary expenses is like pruning a tree – it fosters healthier, more robust growth. Inspect your expenditures to identify areas where costs can be trimmed without impacting operational efficiency.

- Conduct Regular Expense Audits: Periodically review all expenses to identify non-essential costs that can be reduced or eliminated. Look for subscriptions, services, or utilities that your business can do without.

- Implement Cost-Control Measures: Establish a culture of cost-consciousness within your organization. Encourage departments to be mindful of their spending and to find innovative ways to reduce costs.

- Outsource Non-Core Activities: Consider outsourcing non-core functions such as accounting, HR, or IT support. This can often be more cost-effective compared to maintaining these functions in-house.

Common Cash Flow Challenges

Up to this point, we’ve explored what cash flow is and discussed strategies for improving its management.

However, it’s equally important to consider your potential challenges.

Here are some common challenges to keep in mind:

1. Late Payments from Customers

One of the most widespread cash flow issues is the delay in receiving customer payments. This can severely impact your cash reserves and disrupt operational activities.

- Impact: Late payments hinder your ability to meet financial obligations on time, potentially jeopardizing supplier relationships and damaging your credit reputation.

- Solution: Proactively manage accounts receivable. Implement stringent credit policies, send timely invoices, and follow up regularly. Consider offering discounts for early payments to incentivize prompt payment.

2. Overestimating Sales Projections

Overly optimistic sales forecasts can lead to overspending and excessive inventory, straining your cash flow.

- Impact: This mismatch between projected and actual sales can result in surplus inventory, additional storage costs, and tied-up capital that could be better utilized elsewhere.

- Solution: Adopt a conservative approach to sales forecasting. Base your projections on concrete data and market analysis. Regularly review and adjust forecasts based on actual sales performance.

3. High Overhead Costs

Running a business inevitably comes with fixed and variable overhead costs. However, these costs can severely drain your cash flow when they become disproportionately high.

- Impact: Excessive overhead costs reduce your net cash flow, leaving less capital available for growth initiatives or unforeseen expenses.

- Solution: Conduct regular expense audits to identify and eliminate unnecessary costs. Optimize your workplace efficiency by renegotiating contracts or outsourcing certain functions.

4. Seasonal Fluctuations

Businesses with seasonal sales patterns often experience cash flow volatility, with revenues peaking during high seasons and plunging during off-seasons.

- Impact: These fluctuations can create cash shortfalls, making it difficult to cover operational expenses during slower periods.

- Solution: Develop a cash flow forecast that accounts for seasonal variations. Create a cash reserve during peak seasons to cushion the off-season periods. Diversify your product or service offerings if possible, to maintain steadier revenue streams year-round.

5. Rapid Expansion

While growth and expansion are positive indicators of business success, they can also strain cash flow if not managed properly.

- Impact: Rapid expansion often requires a significant up-front investment in inventory, staffing, and infrastructure, which can outstrip your available cash flow.

- Solution: Plan your expansion carefully. Ensure you have sufficient working capital to support growth. Consider phased expansion strategies and explore external financing options if necessary.

6. Poor Inventory Management

Inefficient inventory management, such as overstocking or understocking, can have dire consequences on cash flow.

- Impact: Overstocking ties up cash in unsold inventory, while understocking can lead to missed sales opportunities and dissatisfied customers.

- Solution: Implement robust inventory management systems. Use tools that allow for real-time inventory tracking and adopt practices like just-in-time (JIT) inventory to align stock levels with actual sales demand.

7. Unexpected Expenses

Unexpected costs, such as emergencies, equipment breakdowns, or sudden market changes, can disrupt your cash flow balance.

- Impact: These unplanned expenses can drain your cash reserves, leaving your business vulnerable to cash shortages.

- Solution: Build a contingency fund to cover unforeseen expenses. Maintain a line of credit as a backup for emergencies. Regularly review and update your risk management strategies.

Bottom Line

Enhancing your cash flow can significantly strengthen your company and establish a solid foundation for future growth. Although challenges may arise, a well-planned approach to managing cash flow can secure your business’s financial health and propel it toward success.

Additionally, it’s crucial to ensure that your decisions concerning product or service development, marketing, customer service, and client acquisition are on point.

FAQs on Cash Flow Management

Q1. What is Cash Flow Management?

- Cash flow management involves overseeing and optimizing the inflow and outflow of cash within your business. It ensures that your company has enough liquidity to cover its obligations while maximizing the use of available funds for growth and investment.

Understanding cash flow can help you effectively plan for future expenses, prevent crises, and make informed financial decisions.

Q2. How Can I Improve My Cash Flow Management?

Here are some strategies to enhance cash flow management:

- Accelerate Receivables: Encourage customers to pay sooner, perhaps by offering discounts for early payments.

- Delay Payables: Where possible, negotiate longer payment terms with suppliers.

- Monitor Expenses: Regularly review and control expenditure to prevent unnecessary costs.

- Manage Inventory: Optimize inventory levels to reduce holding costs without sacrificing the ability to meet customer demand.

- Invest Prudently: Allocate cash for investments that promise good returns while maintaining sufficient cash reserves.

Q3. What Tools and Software Can Assist in Cash Flow Management?

- Various tools and software can simplify cash flow management, such as:

- QuickBooks: Provides comprehensive accounting solutions with cash flow tracking features.

- Xero: Offers cloud-based accounting with real-time cash flow updates.

- Float: Integrates with accounting software to offer in-depth cash flow forecasting and management.

- Pulse: A straightforward tool designed specifically for cash flow management and monitoring.

- Juntrax Solutions: Specializes in managing project cash flow, offering tools to track budget allocation, expenses, and financial forecasting for individual projects, thereby ensuring better control and efficiency.

Q4. What is a Cash Flow Statement?

- A. A cash flow statement is a financial document that provides a detailed summary of a company’s cash inflows and outflows over a specific period. It is divided into three main sections:

- Operating Activities: Cash generated or spent in the course of regular business operations.

- Investing Activities: Cash used in or generated from investments in business infrastructure or other companies.

- Financing Activities: Cash obtained from or paid to investors and lenders, such as through loans, stock issuance, or dividends.

Q5. How Often Should I Review My Cash Flow?

- Regularly reviewing your cash flow is crucial. Monthly reviews are standard practice, but weekly or even daily reviews may be necessary for businesses with higher transaction volumes or more volatile cash flow.

Consistent monitoring ensures you can promptly identify and address potential issues.

2 thoughts on “Complete Guide to Cash Flow Management”

Comments are closed.

Hi, I log on to your new stuff daily. Your writing style is witty,

keep doing what you’re doing!