How to Manage and Track Project Cash Flow ?

Did you know that 91% of the small businesses do not survive past their fifth year due to cash flow challenges? This emphasises the importance of understanding and effectively managing project cash flow.

Accurate cash flow tracking is crucial for ensuring financial stability and long-term success. By keeping a close eye on your cash flow, you can make informed decisions, avoid budget overruns, and maintain healthy financial practices.

In this guide, we will explore project cash flow, what it is, and explain how to calculate and manage it. Additionally, we’ll provide an illustrative example to enhance your understanding.

What Is Project Cash Flow?

Cash flow refers to the movement of money into and out of a project or business. In simpler terms, it’s the lifeblood that keeps any project or business running smoothly.

Cash flow can be understood as the schedule of money coming in (positive cash flow) and going out (negative cash flow) of a project or business. Positive cash flow represents the income or receipts, while negative cash flow denotes the expenditures or payments.

When you consider the element of time, you get “flow speed,” which measures how quickly money moves in and out.

Cash flow is crucial for planning and executing financial strategies in project management. Project cash flow can be viewed as a timeline of payments that an owner must make over the project’s duration.

5 Crucial Reasons Timesheets are Essential for Small and Medium-Sized Enterprises SMEs

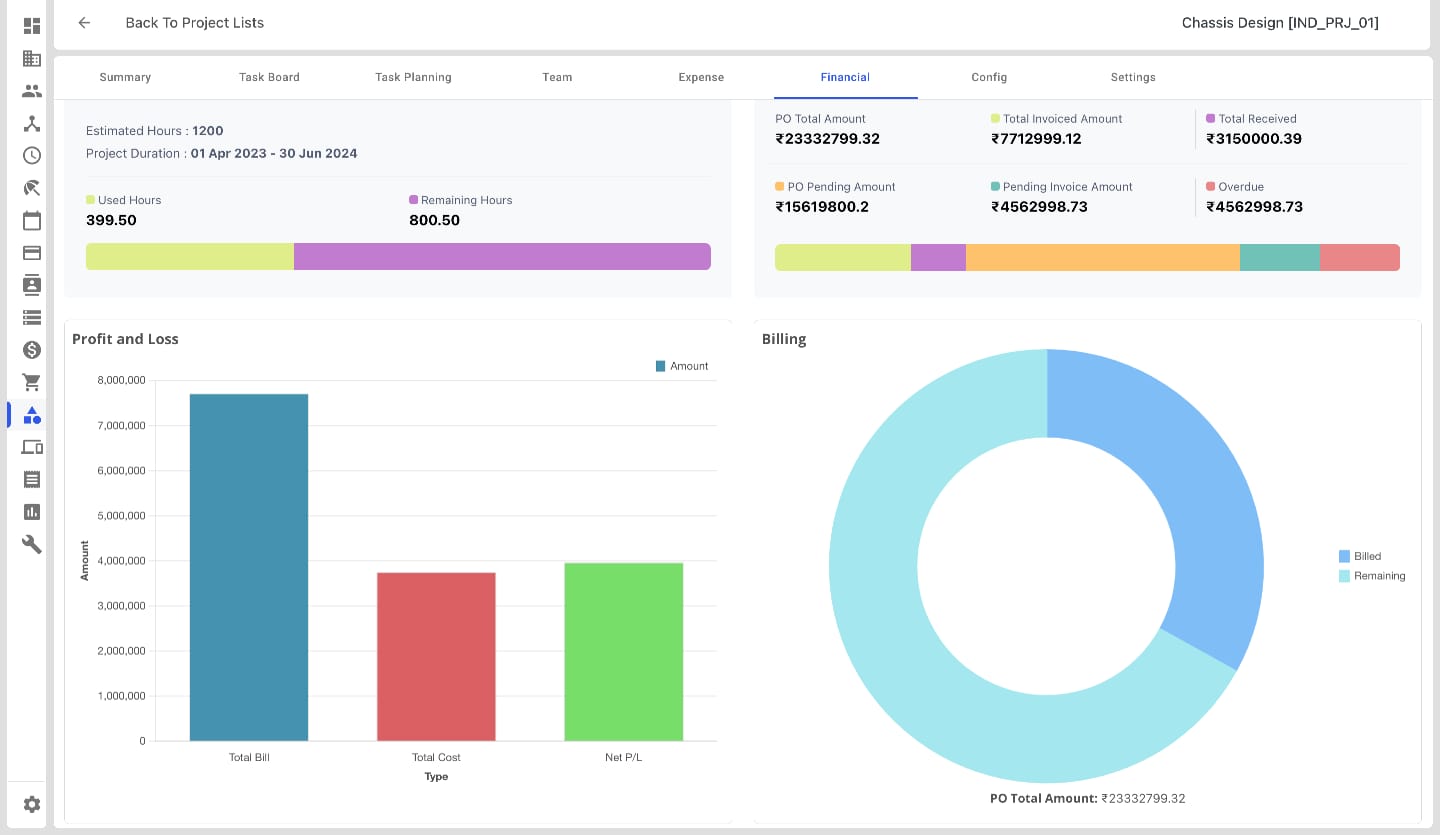

Source image: Juntrax Financials dashboard

Project cash flow refers to the movement of funds into and out of a project. It’s the lifeblood that fuels the machinery of any project, representing the financial inflows received and the outflows spent on the project over a specific period.

At its core, project cash flow embodies the concept of liquidity in a project-centric context, tracking the cash that flows in as revenue and out as expenses.

A project’s cash flow can be positive or negative:

- Positive Cash Flow: This occurs when the cash inflows from the project (such as payments from clients) exceed the cash outflows (such as payments to suppliers). It signals financial health, suggesting that a project has ample liquidity to cover its expenses and possibly invest in growth.

- Negative Cash Flow: This scenario unfolds when cash outflows surpass cash inflows. It raises red flags about a project’s financial health, indicating potential risks of running into cash shortages that could impede progress or necessitate additional funding.

What is the importance of Project Cash Flow Management?

Managing project cash flow involves rigorously laying out and executing strategies to monitor, control, and optimize cash flow. The ultimate goal is to maintain a positive cash flow, ensuring that a project remains financially viable throughout its lifecycle.

Effective cash flow management hinges on precise planning, forecasting, and tracking of both cash inflows and outflows.

Here lies the crux of managing project cash flow: it enables project managers and stakeholders to make informed decisions. By comprehensively understanding where funds are coming from and where they’re going, project leaders can strategize proactively, identifying potential cash shortfalls or surpluses ahead of time and adjusting plans accordingly.

Furthermore, effective cash flow management safeguards against financial uncertainties, providing a buffer that allows projects to navigate unforeseen expenses or payment delays without derailment.

How to Manage the Cash Flow of Your Project?

To manage your project cash flow, you first have to know how to calculate it. Fortunately, calculating project cash flow is straightforward.

It involves subtracting the project costs from the cash generated by the project. This calculation excludes fixed operating costs and any other revenue or expenses not directly related to the project.

While the formula is simple, there are specific steps you need to follow for proper management of your project cash flow.

Identify All Project Cash Inflows

The first step to managing your project’s cash flow is to understand the cash flow of your project. Project cash inflows refer to the money coming into your project from various sources.

Here are some common sources:

- Project Revenue: This includes income generated directly from the project’s activities, such as sales or service fees.

- Client Payments: Client payments made for completed milestones or deliverables within the project.

- Funding: This could be in the form of grants, loans, or investments secured to finance the project.

After identifying all the project cash inflows, sum them up, typically on a monthly basis.

Timing of Cash Inflows

Equally important as identifying the sources of cash inflows is understanding their timing. Knowing when these inflows will occur helps in planning and ensures that you have the necessary funds available when needed. Consider the following aspects:

- Schedule of Payments: Establish when you expect to receive payments from clients. This can be based on project milestones, monthly billings, or other predefined schedules.

- Funding Disbursements: Understand the disbursement schedule if your project is funded through external sources. Grants or loans might be released in tranches, impacting your cash flow timeline.

- Revenue Projections: Estimate when the project will start generating revenue and how consistent that revenue will be. This helps in forecasting cash availability.

Tips To Properly Identify All Project Cash Inflows

- Create a Cash Inflow Log: Maintain a detailed log of all expected cash inflows, including the source, amount, and expected date of receipt. This log will be a reference and help track actual inflows against projections.

- Align with Project Milestones: Synchronize cash inflows with project milestones. Ensure that significant payments coincide with key project stages to maintain a steady cash flow.

- Plan for Delays: Be prepared for potential delays in receiving payments or funding. Have a contingency plan to manage such delays without disrupting the project’s progress.

- Regular Reviews: Periodically review your cash inflow projections against actual receipts. Adjust your plans as necessary to accommodate any discrepancies.

Estimate All Project Costs and Cash Outflows

Project costs and cash outflows refer to the money spent on various aspects of the project. Here are the main categories to consider:

- Labor Costs: This includes wages and salaries for all personnel involved in the project, from project managers and engineers to administrative staff and laborers.

- Materials: Costs related to procuring raw materials, components, and supplies needed for the project’s execution.

- Equipment: Expenses for purchasing or leasing equipment and machinery required for the project.

- Overhead: Indirect costs such as utilities, office space, and other administrative expenses that support the project.

Estimating the Timing of Cash Outflows

Once you have identified all project-related costs, the next step is to estimate when these expenses will occur. This helps in creating a cash outflow schedule that aligns with your project timeline.

Consider the following aspects:

- Labor Payment Schedule: Determine the frequency of payroll disbursements (e.g., weekly, bi-weekly, monthly) and align them with your project milestones.

- Material Purchase Timing: Plan material purchases based on the project phases. Ensure that materials are procured just in time for their use to avoid excess inventory costs.

- Equipment Expenses: Schedule equipment purchases or lease payments according to the project’s needs. Consider the timing of significant expenditures to avoid cash flow bottlenecks.

- Overhead Costs: Estimate monthly overhead expenses and include them in your cash outflow schedule to ensure continuous project support.

Tips for Properly Estimating All Project Costs and Cash Outflows

- Create a Detailed Cost Breakdown: Develop a comprehensive breakdown of all project-related costs, categorized by labor, materials, equipment, and overhead. This provides a clear picture of where the money is going.

- Develop a Cash Outflow Schedule: Organize your estimated expenses into a cash flow schedule that aligns with your project timeline. This helps you anticipate when funds will be needed.

- Monitor and Adjust: Regularly track actual expenses against your estimates. Adjust your cash outflow schedule as necessary to accommodate any changes in project scope or unexpected costs.

- Plan for Contingencies: Include a contingency budget for unforeseen expenses in your cash outflow schedule. This financial buffer can help manage risks and keep the project on track.

Establish the Profitability of the Project

Understanding a project’s profitability is crucial for managing cash flow as it highlights the potential returns against initial investments. By calculating the net profit and evaluating the financial viability, you can make informed decisions about the project’s future.

Essentially, it shows how much revenue you can expect for every dollar invested.

To determine this, conduct a cost-benefit analysis to calculate the profitability index. If the index is above one, the project is financially viable. Conversely, an index below one suggests the project may not be a wise investment.

Steps to Calculate Net Profit

- Determine Total Revenue: Identify all sources of income generated by the project. This includes sales revenue, client payments, and any other project-specific income streams.

- Sum Up Total Costs: Add up all the expenses related to the project. Ensure you include direct costs (labor, materials, equipment) and indirect costs (overhead, administrative expenses).

- Subtract Total Costs from Total Revenue: Use the formula above to calculate the net profit. This figure represents the financial gain or loss from the project.

Tips to Establish the Profitability of the Project

- Regular Monitoring: Continuously monitor the project’s financial performance against your profitability targets. Regular reviews help identify any deviations early and allow for timely corrective actions.

- Scenario Planning: Develop different financial scenarios (best case, worst case, most likely) to understand the range of potential outcomes. This helps in making more resilient financial plans.

- Stakeholder Communication: Keep stakeholders informed about the project’s profitability status. Transparent communication fosters trust and ensures everyone is aligned with the

Create a Cost Baseline and Project Budget

Establishing a cost baseline and project budget is fundamental to effectively managing and tracking project cash flow.

A cost baseline is a detailed budget that outlines the expected costs of a project over time. It serves as a reference point against which actual project expenses are measured. This baseline helps track financial performance and identify deviations from the original budget.

While a project budget is a comprehensive financial plan that details all the costs associated with the project. It includes the cost baseline and additional financial considerations to ensure the project stays on track.

Steps to Create a Cost Baseline

- Identify Cost Elements: List all the cost elements related to the project, including labor, materials, equipment, and overhead.

- Estimate Costs: Estimate the costs for each element. Use historical data, vendor quotes, and expert judgment to ensure accuracy.

- Develop a Time-Phased Budget: Organize the estimated costs over the project timeline. This helps in understanding when funds will be needed and planning cash flow accordingly.

- Include Contingencies: Add a contingency reserve to account for unforeseen expenses. This provides a financial buffer for managing risks.

Tracking and Comparing Costs

Regularly comparing actual costs against the cost baseline is essential for effective financial management. This process helps in identifying variances and taking corrective actions to keep the project within budget.

Steps to Track Costs

- Record Actual Costs: Continuously record all project expenses as they occur. Use accounting software or project management tools to maintain accuracy.

- Compare Against Baseline: Regularly compare actual costs with the cost baseline. Identify any deviations and analyze their causes.

- Analyze Variances: Determine whether variances are due to cost overruns, changes in project scope, or other factors. This analysis helps in understanding the financial impact and making informed decisions.

- Adjust Budget as Needed: If significant deviations are identified, adjust the project budget to reflect the new financial reality. Ensure that stakeholders are informed of any changes.

Tips to Create a Cost Baseline and Project Budget

- Use Budgeting Tools: Utilize project management and budgeting tools to automate cost tracking and analysis. These tools provide real-time insights and facilitate accurate reporting.

- Implement Regular Reviews: Schedule regular financial reviews to assess the project’s financial status. This ensures continuous oversight and timely identification of issues.

- Engage Stakeholders: Keep stakeholders informed about the project’s financial performance. Transparent communication fosters trust and ensures alignment with financial goals.

- Prepare for Variances: Expect and plan for variances. Develop strategies for managing cost overruns and ensure that your project can adapt to financial changes.

Monitor Costs Throughout the Project Execution

Monitoring costs involves tracking actual project expenses against the planned budget. This ongoing process helps in identifying variances early, allowing for timely corrective actions and ensuring the project remains financially on track.

If you can quickly identify cost overruns, you can promptly implement actions to mitigate them and keep your project costs on track.

Key Steps to Monitor Costs

- Set Up a Cost Monitoring System: Implement a robust system for tracking all project expenses. Use project management software or accounting tools to record costs accurately and in real-time.

- Regular Financial Reviews: Schedule regular reviews to compare actual expenses against the budget. Weekly or monthly reviews help in maintaining continuous oversight.

- Identify Cost Variances: Analyze any discrepancies between planned and actual costs. Determine whether these variances are due to cost overruns, changes in project scope, or other factors.

Adjusting the Budget

If unforeseen changes or scope adjustments occur, it may be necessary to revise the project budget. This ensures that the financial plan remains realistic and achievable.

- Evaluate the Impact of Changes: Assess how changes in project scope or unexpected expenses affect the overall budget. Calculate the additional costs and determine whether they can be absorbed within the existing budget or if adjustments are needed.

- Communicate with Stakeholders: Inform stakeholders about any budget adjustments. Providing clear explanations and justifications fosters transparency and maintains trust.

- Update the Budget: Revise the budget to reflect the new financial reality. Ensure that all changes are documented and aligned with the project’s financial goals.

Tips for Monitoring Costs Throughout the Project Execution

- Utilize Cost Management Tools: Leverage cost management tools to automate expense tracking and reporting. These tools provide real-time insights and facilitate accurate financial monitoring.

- Implement Contingency Plans: Develop contingency plans to manage unexpected costs. Having a financial buffer allows for flexibility and reduces the risk of financial strain.

- Engage the Project Team: Encourage the project team to be mindful of costs and report any potential issues early. Collaborative efforts help in maintaining control over expenses.

- Regularly Update Financial Reports: Keep financial reports up-to-date to reflect the current status of project expenses. Accurate reporting aids in decision-making and ensures that everyone is informed about the project’s financial health.

Allocate Resources & Track Resource Utilization

Another thing to monitor is your resources and how you’re allocating them. Resource allocation involves assigning the right resources to the right tasks at the right time to ensure project efficiency and cost-effectiveness.

- Identify Resource Requirements: Determine the resources needed for each project task. This includes labor, equipment, materials, and any specialized tools or software.

- Match Resources to Tasks: Allocate resources based on their skills, availability, and suitability for the task. Prioritize the most critical tasks for resource allocation.

- Optimize Resource Use: Avoid overallocation or underutilization of resources. Balancing resource load prevents burnout and ensures that all resources are used effectively.

Monitoring resource utilization helps in maintaining control over project costs and ensuring that resources are used efficiently.

Utilizing Project Management Software

Project management software is vital in tracking resource utilization in real time. These tools provide valuable insights into how resources are being used and help identify any inefficiencies.

- Real-Time Monitoring: Use software to track resource usage in real-time. This allows you to see which resources are being used, for how long, and whether they are being over or under-utilized.

- Resource Utilization Reports: Generate reports to analyze resource utilization patterns. These reports help in understanding the efficiency of resource use and identifying areas for improvement.

- Adjust Resource Allocation: Based on the insights gained from tracking, adjust resource allocation to address any imbalances. This ensures optimal use of resources and helps in minimizing costs.

Tips to Allocate Resources & Track Resource Utilization

- Regular Resource Audits: Conduct regular audits to assess resource utilization. This helps identify discrepancies and take corrective actions promptly.

- Forecasting Resource Needs: Use historical data and project management tools to forecast future resource needs. Accurate forecasting helps plan resource allocation and avoid last-minute adjustments.

- Engage the Project Team: Involve the project team in resource planning and tracking. Their insights and feedback can help in identifying potential issues and improving resource management practices.

- Implement Resource Management Best Practices: Adopt best practices in resource management, such as using resource leveling techniques to balance the workload and avoid bottlenecks.

Project Cash Flow Analysis Example

To better wrap our heads around project cash flow, let’s imagine a real-life cash flow scenario in construction. The project is expected to last one year, with an estimated budget of $500,000. The cash inflows come from periodic payments from the client, while the cash outflows include costs for labor, materials, and equipment.

1. Identify Cash Inflows

Begin by outlining all sources of cash inflows. In this example, the client agrees to pay in four installments:

- Initial payment of $150,000 at the start

- Three payments of $100,000 at the end of each quarter

2. Identify Cash Outflows

Next, list all expected expenses. For our construction project, these may include:

- Labor: $200,000

- Materials: $150,000

- Equipment: $50,000

- Miscellaneous costs: $100,000

3. Create a Cash Flow Timeline

Map out the cash inflows and outflows over the project’s duration:

| Month | Cash Inflows | Cash Outflows | Net Cash Flow |

| 1 | $150,000 | $100,000 | $50,000 |

| 2 | $0 | $50,000 | -$50,000 |

| 3 | $0 | $50,000 | -$50,000 |

| 4 | $100,000 | $50,000 | $50,000 |

| 5 | $0 | $50,000 | -$50,000 |

| 6 | $0 | $50,000 | -$50,000 |

| 7 | $100,000 | $50,000 | $50,000 |

| 8 | $0 | $50,000 | -$50,000 |

| 9 | $0 | $50,000 | -$50,000 |

| 10 | $100,000 | $50,000 | $50,000 |

| 11 | $0 | $50,000 | -$50,000 |

| 12 | $0 | $50,000 | -$50,000 |

4. Analyze the Cash Flow

Examine the net cash flow to identify periods of surplus and deficit. In this example, there are months where outflows exceed inflows, leading to negative cash flow. Understanding these patterns allows for better financial planning and identifying when additional funding may be needed.

5. Implement Mitigation Strategies

To address negative cash flow periods, consider strategies such as:

- Adjusting Payment Schedules: Negotiate with the client for more frequent payments.

- Securing Short-term Financing: Obtain a line of credit or short-term loan to cover deficits.

- Cost Management: Optimize spending by negotiating better rates with suppliers or deferring non-essential expenses.

Bottom Line

Effectively managing and tracking project cash flow is essential for ensuring that your projects stay within budget and on schedule. By understanding the inflows and outflows of cash, you can make informed decisions, avoid financial bottlenecks, and maintain the financial health of your projects.

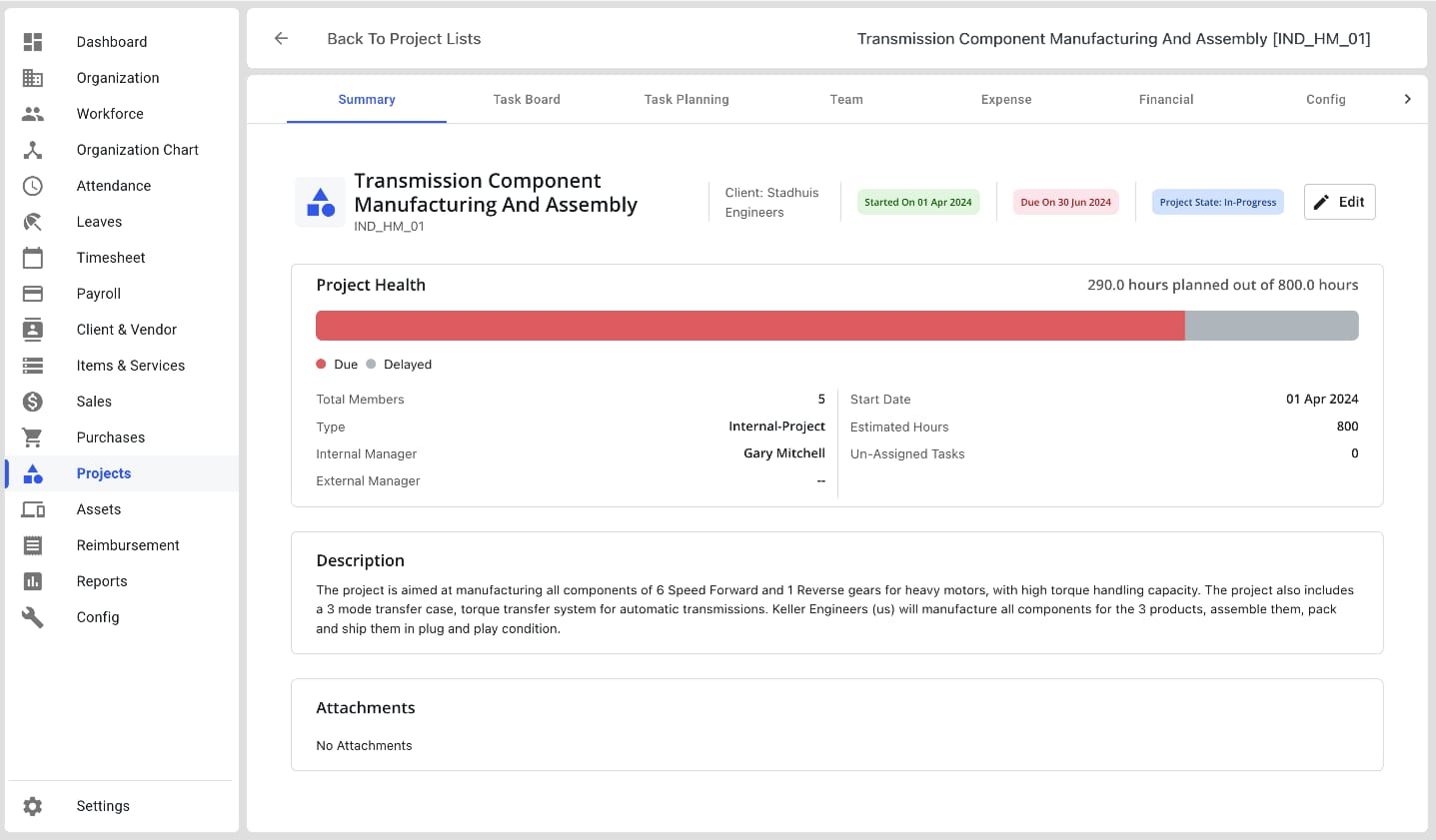

Empower your business with Juntrax’s Financial solution: seamlessly integrate accounting, invoicing, expense tracking, and reimbursements to gain a comprehensive and real-time view of your financial landscape.

Generate detailed reports to optimize budgets and analyze spending effectively. Stay compliant with built-in tools that help you stay on top of regulations.