Why Cloud-Based Payroll Software is a Must-Have for Modern Businesses

Handling payroll shouldn’t be a daunting administrative burden.

Yet, for larger enterprises, the complexity increases significantly.

Payroll managers in multinational corporations must navigate diverse factors, including local laws and regulatory standards, while also being accessible to employees across different time zones.

If you find yourself bogged down by administrative tasks and unable to focus on crucial business activities, it’s time to consider transitioning to the cloud. The advantages of a cloud-based payroll system greatly surpass those of any outdated legacy systems still in use.

According to a Deloitte report, businesses that adopted cloud-based payroll systems reported a 30% reduction in processing time and a marked improvement in accuracy.

This article delves into why cloud-based payroll software is essential for any forward-thinking organization, exploring its many advantages in streamlining operations, ensuring compliance, and fostering a more agile business environment.

What is Cloud-Based Payroll Management Software?

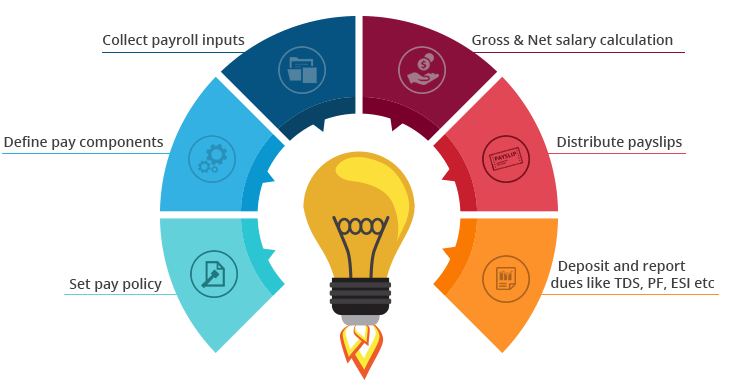

Cloud-based payroll management software is a modern solution for handling payroll processes via the Internet. This type of software is hosted on remote servers maintained by service providers, allowing businesses to access payroll functionalities without needing on-premises hardware or extensive IT resources.

Unlike traditional payroll systems that require on-premise hardware and software installations, cloud-based solutions are hosted on remote servers, making them accessible via the Internet from anywhere at any time.

This accessibility is one of its most notable advantages, allowing payroll managers and employees to access vital information and perform tasks without being tethered to a physical location.

Key Features of Cloud-Based Payroll Management Software

Accessibility and Convenience

- Remote Access: Users can access payroll data from anywhere with an internet connection, making it ideal for remote or hybrid work environments.

- User-Friendly Interfaces: Employees can easily view their pay information and update personal data through intuitive dashboards accessible on various devices.

Automation and Efficiency

- Automated Processes: Routine tasks such as payroll calculations, tax filings, and compliance updates are automated, reducing the administrative burden on HR teams.

- Real-Time Data Updates: Payroll systems provide real-time access to employee data, ensuring that all calculations are accurate and up-to-date.

Security and Compliance

- Enhanced Security Measures: Cloud payroll solutions incorporate robust security protocols, including encryption and multi-factor authentication, to protect sensitive payroll data from breaches.

- Compliance Management: The software automatically updates to reflect changes in tax laws and regulations, helping businesses maintain compliance without manual intervention.

Traditional Payroll Systems vs Cloud-Based Payroll Software

| Feature/Aspect | Traditional Payroll Systems | Cloud-Based Payroll Software |

| Accessibility | Limited to office locations | Accessible anytime, anywhere |

| Cost | Higher upfront costs (software/hardware) | Lower initial costs (subscription model) |

| Automation | Manual processes | Automated calculations and updates |

| Scalability | Difficult to scale | Easily scalable with business needs |

| Maintenance | Requires in-house IT support | Managed by the service provider |

| Security | Vulnerable to data breaches | Enhanced data security with encryption |

| Accuracy | Prone to human errors | Higher accuracy due to automation |

| Compliance Management | Manual updates required | Automatic compliance updates |

| User Experience | Potentially complicated interface | User-friendly interfaces |

Benefits Of Cloud Based Payroll For Your Business

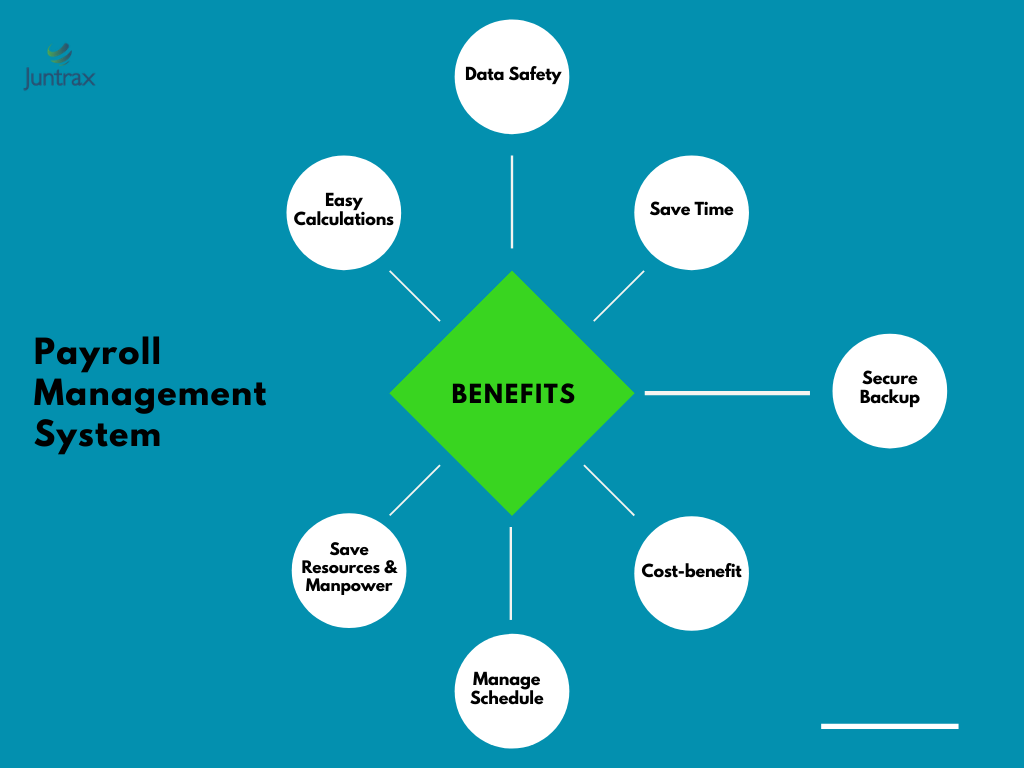

Cost Savings

Cloud-based payroll software offer significant cost savings for businesses by streamlining operations and eliminating the need for extensive physical infrastructure.

Reduced Infrastructure Costs

One of the most compelling advantages of cloud-based payroll software is eliminating the need for expensive hardware and software.

Traditional payroll software often require businesses to invest in servers, software licenses, and ongoing maintenance.

In contrast, cloud payroll solutions are hosted on external servers managed by the service provider. This shift reduces both initial capital expenditures and ongoing operational costs.

By utilizing cloud technology, you can avoid the costs associated with purchasing and maintaining physical servers, software updates, and IT support. The provider handles all maintenance, ensuring that the system is always up to date without any additional effort or expense from the business. This leads to lower upfront costs and minimizes the financial burden of ongoing maintenance and upgrades.

Predictable Expenses

Another financial benefit of cloud-based payroll systems is their subscription-based pricing model.

Most providers offer flexible subscription plans that allow businesses to pay a predictable monthly or annual fee. This model enables companies to forecast their expenses more accurately, as they can anticipate their payroll costs without worrying about hidden fees related to software upgrades or unexpected maintenance.

This predictability helps you to manage your budgets more effectively, allowing you to allocate resources to other critical areas of operation.

Additionally, many cloud payroll solutions include various features within their subscription price, reducing the need for additional investments in separate software or services.

Time Efficiency and Automation

The automation capabilities of cloud-based payroll systems significantly enhance operational efficiency by minimizing manual tasks and expediting processes.

Automated Processes

Cloud payroll systems automate complex tasks such as tax calculations, deductions, and compliance reporting. This automation speeds up the payroll process and reduces the likelihood of human errors that can occur with manual data entry.

By automating these processes, HR and finance teams can focus on more strategic initiatives rather than getting bogged down in routine administrative tasks.

For example, automated tax calculations ensure that employees are taxed correctly based on current regulations, which reduces the risk of costly penalties for non-compliance.

Additionally, automated compliance reporting simplifies the process of adhering to labor laws and regulations, allowing you to stay compliant without dedicating excessive time and resources.

Streamlined Workflows

Cloud payroll systems enhance overall workflow efficiency by facilitating faster approvals and processing through automated alerts and notifications. These systems can notify managers when approvals are needed or when deadlines are approaching, ensuring that payroll is processed on time without delays.

This streamlined approach improves productivity and enhances communication across departments. With clear visibility into payroll processes and timelines, HR teams can collaborate more effectively with finance departments, leading to a smoother overall operation.

Accessibility

The flexibility offered by cloud-based payroll solutions is crucial in today’s increasingly remote work environment.

Remote Access

Cloud-based payroll software can be accessed from anywhere via the Internet, allowing HR professionals and employees to manage payroll tasks remotely. This accessibility is particularly important as more organizations adopt hybrid or fully remote work models.

Employees can check their pay stubs, submit time-off requests, or update personal information from any location, making staying engaged with their compensation details easier.

This flexibility also benefits HR teams by allowing them to manage payroll processes without being tied to a specific location.

Whether working from home or on-the-go, HR professionals can ensure that payroll runs smoothly regardless of where they are physically located.

Employee Self-Service Portals

Many cloud payroll solutions include self-service portals for employees. These portals empower employees to access their payslips, tax documents, and personal information at any time without contacting HR for assistance.

This promotes transparency and fosters trust between employees and management while significantly reducing the administrative burden on HR teams.

By enabling employees to manage their own information, businesses can free up HR resources for more strategic tasks rather than handling routine inquiries about paychecks or benefits.

Data Security

Data security is a paramount concern for any business handling sensitive employee information. Cloud-based payroll systems provide enhanced security measures that often surpass what smaller organizations can achieve with traditional on-premises solutions.

Enhanced Security Measures

Cloud providers invest heavily in security protocols to protect sensitive data. This includes advanced encryption methods that safeguard data both in transit and at rest, multi-factor authentication to prevent unauthorized access, and regular security audits to identify potential vulnerabilities.

These robust security measures ensure that employee information remains confidential and secure from cyber threats.

For many small to mid-sized businesses, achieving this level of security independently would be prohibitively expensive and complex.

Compliance with Regulations

In addition to security measures, cloud payroll systems are designed to comply with various data protection laws and regulations.

This compliance helps businesses avoid costly violations while safeguarding sensitive employee information according to legal standards.

By utilizing a compliant cloud payroll solution, you can mitigate risks associated with data breaches or regulatory fines while maintaining employee trust through responsible data management practices.

Scalability

As businesses grow and evolve, their operational needs change accordingly. Cloud-based payroll systems provide inherent scalability that allows companies to adapt easily.

Adaptability to Growth

Cloud solutions are designed with scalability in mind, enabling organizations to add new employees or features without significant additional investment or complexity.

As a business expands its workforce or diversifies its offerings, it can seamlessly integrate new functionalities into its existing cloud payroll system.

This adaptability ensures you do not outgrow your payroll solutions as you scale up operations.

Instead of facing the disruption of migrating to a new system during periods of growth, you can continue using your existing platform while expanding its capabilities as needed.

Improved Accuracy

Accuracy in payroll processing is critical for maintaining employee satisfaction and compliance with labor laws.

Reduction of Errors

By automating calculations and processes within cloud-based payroll systems, businesses significantly reduce the likelihood of errors associated with manual data entry.

Automated tax calculations ensure correct deductions based on current regulations while eliminating common mistakes that could lead to overpayments or underpayments.

This emphasis on accuracy ensures that employees receive their compensation correctly and on time every pay period.

Moreover, reducing errors enhances employee satisfaction and minimizes potential legal issues stemming from incorrect wage payments or tax filings.

Easier reporting

By utilizing cloud analytics within your cloud-based payroll system, you can easily analyze real-time data across various fields and receive immediate results. This means there is no lag in information delivery; as soon as data is collected, it is transmitted throughout the system to wherever it is needed.

Real-time data significantly simplifies the generation of mandatory reports, ensuring that all information is current and accurate.

Additionally, it enables the development of more relevant and informed business strategies.

The advantages of transitioning your business to the cloud far outweigh the temporary challenges associated with data migration.

If you need assistance with the migration process or would like to learn more about our cloud-based payroll management software solution, feel free to reach out. We’re always here to help!

12 thoughts on “Why Cloud-Based Payroll Software is a Must-Have for Modern Businesses”

Comments are closed.

I have to convey my respect for your kindness for all those that require guidance on this one field. Your special commitment to passing the solution up and down has been incredibly functional and has continually empowered most people just like me to achieve their dreams. Your amazing insightful information entails much to me and especially to my peers. Thanks a ton; from all of us.

Means a lot!

Thanks a ton!

Hello there! This is my first visit to your blog! We are a group of volunteers and starting a new initiative in a community in the same niche. Your blog provided us beneficial information to work on. You have done a outstanding job!

Fabulous, what a weblog it is! This web site presents valuable data

to us, keep it up.

Thanks for the blog article.Much thanks again.

Wow, great blog article. Fantastic.

I am not that much of a online reader to be honest but your blogs really nice, keep it up! I’ll go ahead and bookmark your website to come back later on. Many thanks

We stumbled over here by a different web page and thought I should check things out. I like what I see so now i’m following you. Look forward to going over your web page repeatedly.